|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Understanding North Carolina Bankruptcy Filings: Key Insights and Considerations

Filing for bankruptcy in North Carolina can be a daunting process, yet it offers a fresh start for those overwhelmed by debt. This article aims to provide a comprehensive overview of the bankruptcy filing process in North Carolina, including types, procedures, and frequently asked questions.

Types of Bankruptcy Filings

Individuals and businesses in North Carolina typically file under two main chapters of the Bankruptcy Code: Chapter 7 and Chapter 13.

Chapter 7 Bankruptcy

Chapter 7 involves the liquidation of assets to repay creditors. It's suitable for individuals with limited income who cannot repay their debts.

Chapter 13 Bankruptcy

Conversely, Chapter 13 allows debtors to retain their assets while creating a repayment plan over three to five years.

Filing Process

The process of filing for bankruptcy in North Carolina involves several critical steps:

- Collecting financial documents and completing credit counseling.

- Filing the bankruptcy petition with the court.

- Attending a meeting of creditors.

- Completing a debtor education course.

Each step requires careful attention to detail to ensure the process goes smoothly.

Considerations Before Filing

Before filing for bankruptcy, consider the following factors:

- Evaluate if bankruptcy is the best solution.

- Understand the impact on your credit score.

- Consider alternative debt-relief options.

Consulting with a professional, such as top bankruptcy lawyers in Maryland, can provide additional guidance and help you make informed decisions.

FAQ Section

What are the eligibility requirements for filing Chapter 7 in North Carolina?

To be eligible for Chapter 7, you must pass the means test, which compares your income to the state median. If your income is below the median, you qualify. Otherwise, further calculations determine your eligibility.

How does filing for bankruptcy affect my credit score?

Bankruptcy can significantly impact your credit score, often lowering it by 200 points or more. However, over time, you can rebuild your credit by managing your finances responsibly.

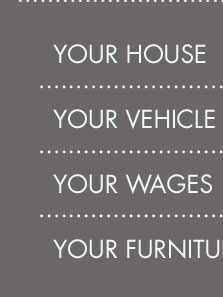

Can I keep my home if I file for Chapter 13 bankruptcy?

Yes, Chapter 13 allows you to keep your home by including mortgage arrears in the repayment plan, enabling you to catch up on payments over time.

What happens to my car if I file for bankruptcy?

In Chapter 7, you might lose your car if it's not covered by exemptions. In Chapter 13, you can keep your car by continuing payments or including it in the repayment plan.

Is it possible to discharge all debts through bankruptcy?

Not all debts can be discharged. Student loans, child support, and certain taxes typically remain. It's crucial to understand which debts can be discharged before proceeding.

For tailored legal advice, consider consulting with experts like top bankruptcy lawyers in Tampa, who can provide personalized guidance based on your situation.

Court Locations - Charlotte. 401 West Trade Street, Suite 2500. Charlotte, NC 28202. Phone (704) 350-7500 - Asheville. 100 Otis Street, Room 112. Asheville, NC ...

It maintains self-service public access terminals where people can view an electronic version of a bankruptcy record.

Mane Source Counseling, PLLC Court: North Carolina Eastern Bankruptcy Court Chapter: 11. Case Num: 5:25-bk-00833. Filed: Mar 07, 2025. Entity: Corporation

![]()